Risk Management 'out of necessity' or because you already do it daily?

A lot of organizations think risk management is a must-do. How can you make Risk Management easily your day-to-day business and how does that help your organization within decision making? Joris from RiskChallenger discusses this topic and some useful tips for you.

Must-do

There is a perception within some organizations that Risk Management is a so-called must do;

An obligation to the boards, management or audit department that must be handled cyclically, separate from the context of ongoing work or day-to-day operations with which the organization is engaged. Viewing Risk Management as such an administrative act reflects on the risk file like this:

- Past undesirable events are given a hypothetical spin, in order to produce a list of active risks

- Control measures are a list of actions, applied ad hoc at the time to best mitigate their impact

- While this method of risk management does provide a picture of relevant uncertainties, it hardly provides tools for proactive management

- Instead of being the desired decision-making tool, risk management is an accountability tool

Day-to-day business

Risk management ensures early detection of risks and possible control measures (early warnings). But applying risk management only to mitigate failure is too one-dimensional. Having a picture of risks and opportunities (and their respective consequences) provides guidance when making difficult decisions, for example:

- Are the costs to be incurred commensurate with mitigating the risk?

- Should investment be made precisely to seize opportunities?

- Are we going in the right direction given the planning and forecasts, or do we need to adjust?

- Which stakeholder has the highest priority, for allocating resources to manage the risk on them?

- Based on the known risks and opportunities, should we give a Go or No-Go?

How do you go from "risk management because you have to," to risk management as a "day-to-day business"?

Tip 1: Prioritize and communicate

Effective risk reporting is about providing the relevant information needed to make decisions on complex project trade-offs. It is essential to prioritize key risks and their potential impact on the organization. Avoid overloading reports with details, which can dilute the main message regarding the most pressing organizational and project goals.

Tip 2: Real-time reporting

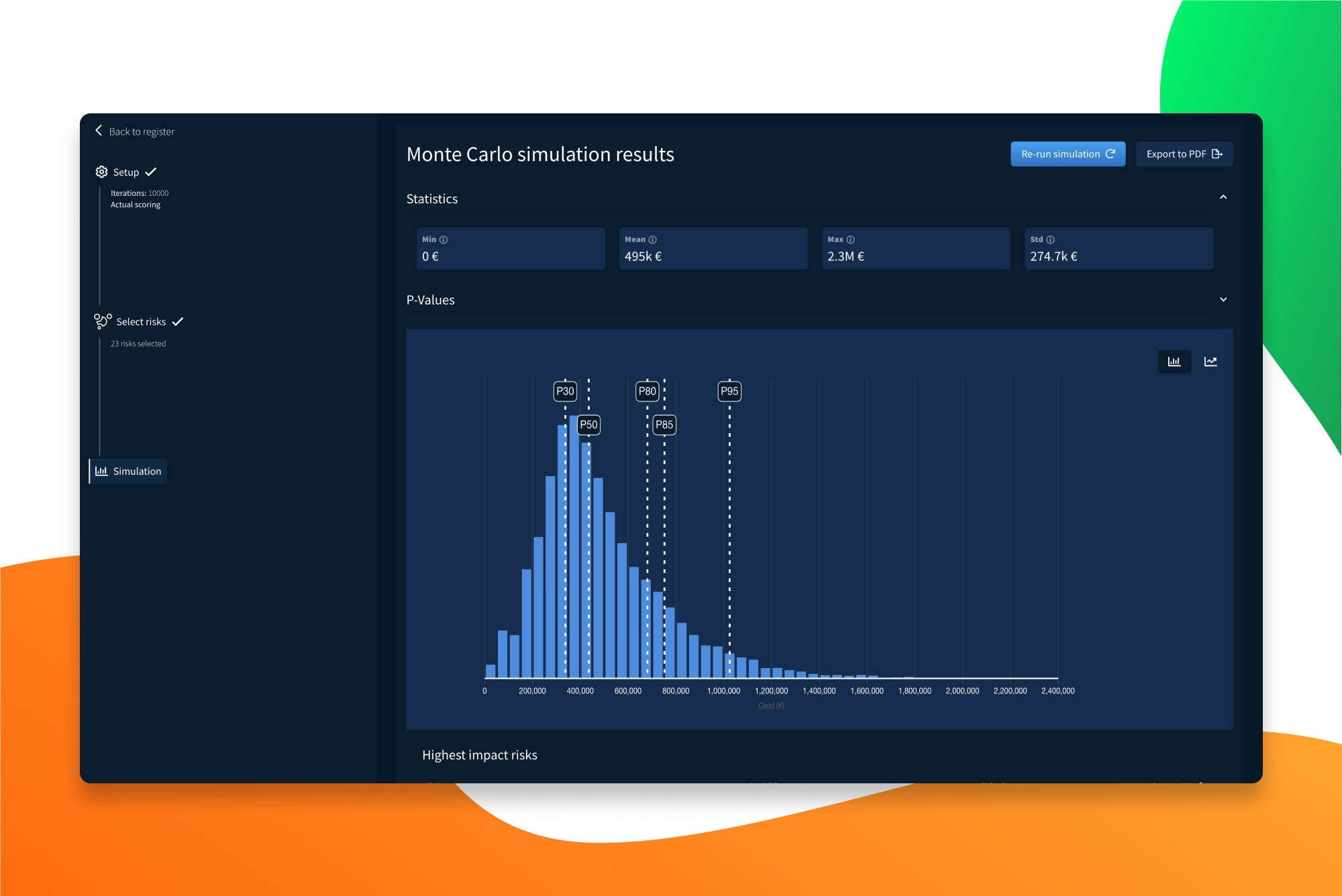

In addition to scheduled risk reports, you can also consider setting up a system where risks, uncertainties and issues are always up to date. As a result, there is practically no threshold to report the risk file in real-time. This facilitates smoother communication, decision-making and action required.

Tip 3: Latent Consistent

Establish a cyclical reporting schedule; ensure that input for this is delivered consistently. Consistency is essential for risk reporting. For good input, set up a clear process with concrete frequency, to constantly have the right people to retrieve up-to-date management information from. With regularity, this process will become embedded in the organization and the tension about getting risks updated in time for reporting disappears.

In short; Risk Management is not a tool just to mitigate failure, but Risk Management helps with decision making on business or project dilemmas.

Therefore, like decision making, Risk Management is day-to-day business.

--

Do you also want risk management to become part of your day-to-day business? We can help you with that! Our software provides a real-time update of your risk file, so you can easily get an overview.

Do you need help setting up risk management in your organization? Our consultants are happy to help. Schedule a meeting with one of our professionals!

Do you have any questions about this article?

Feel free to contact us via live chat or via

support@riskchallenger.nl