Essential Steps for a Successful start with Risk Management

Companies and organisations use numerous strategies and methods to define their own risk management approach and processes. There is, however, an essential requirement which is required in order to carry out risk management in all organisations: A plan!

Companies and organizations use numerous strategies and methods to define their own risk management approaches and processes. However, there is an essential requirement for implementing risk management in all organizations: a starting point note, often called a risk management plan. This may seem like a dead giveaway, but having a risk management plan helps risk managers perform their duties in an organized and efficient manner. Depending on a company's size, type and mission, risk management planning can vary.

Despite these differences, however, most risk management plans are quite similar. That's because of their purpose: to help risk managers carry out their tasks in an organized and efficient manner. In this blog post, we walk through some common steps that most risk managers follow on a daily basis, but do not define and document in advance. We describe the need for each step and why exactly that information is important.

1. Define the Context and Objectives

You are finally building your new risk management process or project! It is essential to define very clearly and precisely the context and objectives within which risk management moves. For example, you can start by identifying specific objectives you want to achieve through risk management, such as protecting assets, ensuring project success or improving decision-making processes. Multiple (sub-)objectives are also possible. This step helps you lay the foundations for risk management in your organization and provides direction for the variables and metadata to be captured in risk!

2. Establish the Scope

When designing the risk management plan, an important step is to define the boundaries of risk management. You begin by clearly delineating the areas, procedures or projects the process covers and where it connects to other disciplines, such as planning, finance and/or quality management. If applicable, you explicitly exclude aspects that have little or no connection to your risk management process. This helps to focus you and your team's efforts on the most important aspects of your organization/project, to save your organization's time and resources, and to maximize the potential benefits of the risk management process. For the interfaces, also document the "deliverables" from the risk management process to best connect the work processes of other disciplines.

3. Identify Stakeholders

Identifying and involving relevant stakeholders in the risk management process is essential for the plan to be successful and highly effective. Stakeholders include internal teams, external partners, customers, regulators and other entities that may affect or be affected by the organization's activities. At RiskChallenger, we promote communication and inclusiveness when it comes to risk management within an organization. One of our in-app features helps to make this aspect even easier by helping you conduct brainstorming sessions where you can engage all stakeholders, place and time-independent that are important to your risk management process.

4. Define Risk Criteria

The next step is to establish criteria to evaluate and categorize risks. These can include factors such as potential impact on objectives, likelihood of occurrence and the organization's risk tolerance. Quantifying and prioritizing based on these criteria, allows you to quickly understand the most important risks to manage to ensure your business/project continuity. The RiskChallenger app has a very convenient and user-friendly structure for defining risk categories and filters. It is essential that clear criteria help identify and prioritize risks throughout the project. With RiskChallenger, it is very difficult to miss new input and developments because everything is clearly and prioritized in front of you!

5. Create a Risk Register

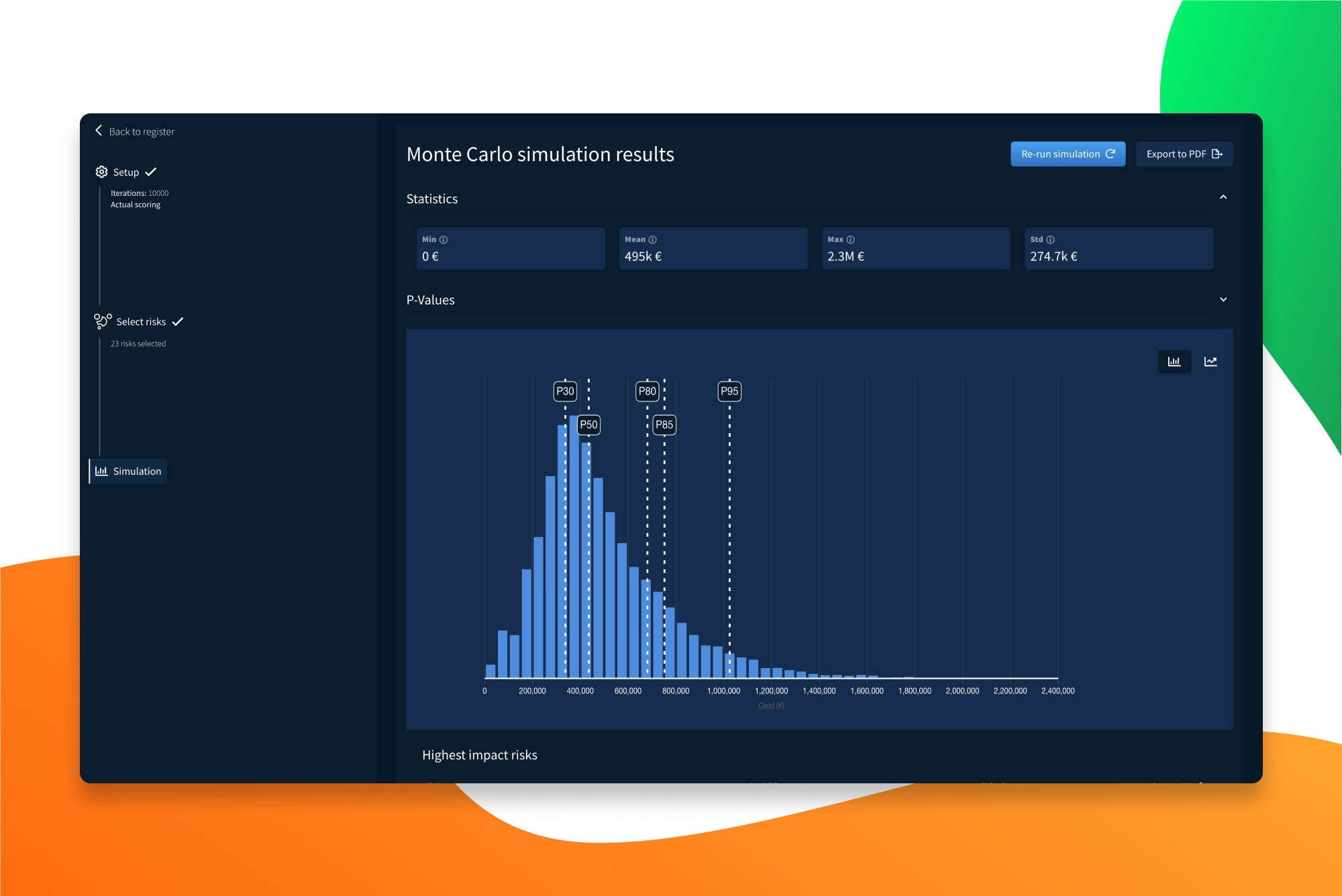

A very important step, especially for large projects, is to document all identified risks, their characteristics and associated response strategies and measures in a risk register. The purpose of the register is to serve as a central repository of information about each risk, which is why we recommend adding starting with the risk register to each start-up phase as a "kick-off essential." In addition, a risk register facilitates ongoing monitoring and management and tasks that occur later in the risk management process.

6. Continuous Improvement

Finally, if you have carefully planned your risk management process, it is very helpful to keep improving your risk management efforts! One way to "continuously improve" is to use insights from the risk management process to consistently evolve your risk management practices. Being open to learning, evaluating and sharing thoughts and experiences creates a natural flow of improvements for risk management processes. But also in terms of content: make various files side by side insightful and learn from the different styles and solution approaches for managing risk. After all, a donkey never bumps the same stone twice!

In other words, by evaluating the effectiveness of your risk management efforts and adjusting strategies based on lessons learned, you can move forward in your organization and in your career as a risk management professional!

Final Thoughts

The steps in this blog are essential for a risk management professional and his organization. Risk management is not a fixed, rigid, one-size-fits-all process and the same goes for the startup phase. The specific steps listed can help you stay organized, focused and precise. However, it is always helpful to leave room for the unexpected and be flexible to change, especially when applying risk management to a project. However, it is important to be explicit about the risk criteria and categories you use to ensure that the terms are interpreted in the same way by the entire team. This makes communication so in risk management efficient and effective!

The RiskChallenger app and our consultants are here to help you create the most suitable and effective risk management plan for your organisation. Book a Demo with us, and we will take you through risk management essentials and the value of communication in risk management!

Do you have any questions about this article?

Feel free to contact us via live chat or via

support@riskchallenger.nl